- The strong rally that started the year has begun to fade. Given the renewed expectations for possibly more Fed hikes than originally anticipated, along with the digestion of the strong gains in January, the NASDAQ is now “only” up +12% on the year, while the Dow is now up only 2% and the S&P 6% year-to-date. Some markets are still holding huge YTD gains – check out the Crypto Corner below.

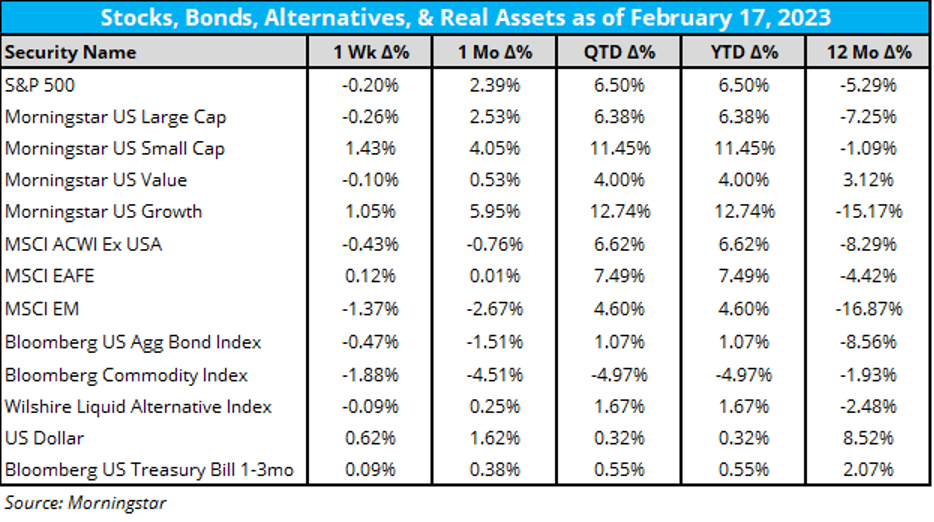

- As for market performance last week:

- The overall US market was essentially flat on the week, with growth and small cap stocks posting just over 1% gains each.

- On the year, the S&P 500 is up nearly 7%. Growth stocks have outperformed value by nearly 9% on the year thus far.

- YTD, international stocks are still slightly edging out domestic.

- Broad commodities are down about 5% on the year after losing nearly 2% last week.

- Bonds are holding onto about a 1% gain on the year.

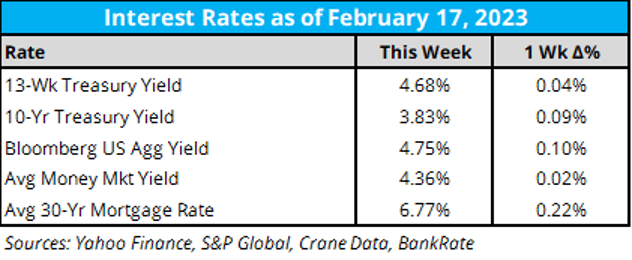

- As for key rates last week:

- Interest rates broadly continued to rise last week. Unfortunately, the largest jump on the week was in the average 30-year mortgage rate.

- However, MM yields continue to rise, providing a nice investment alternative in the face of a lot of market uncertainty and mixed investor sentiment.

- It’s been over 15 years since 1-year T-Bills were this high.

- As for the market-based expectations of what the Federal Reserve will do with short-term rates, here is the handy-dandy CME Fed Watch tool:

- There is now an 80% chance (down 10%) of 25 bpt increase March 1st. 20% chance of a 50 bpt move (up 10%). The current Fed Funds rate is 5.50-5.75%.

- The market most likely thinks we’ll get 75 bpts in short-term rate hikes from current levels to get to 5.50%. There are decent odds to see 5.75% and there is even a chance for 6% still for Fed Funds.

- Bottom line, expectations are shifting to the Fed moving rates higher than earlier expected, holding them at higher levels longer than expected, and not cutting rates until later.

- Great interview of one of OPS’s top partners: Main Management's Kim Arthur.

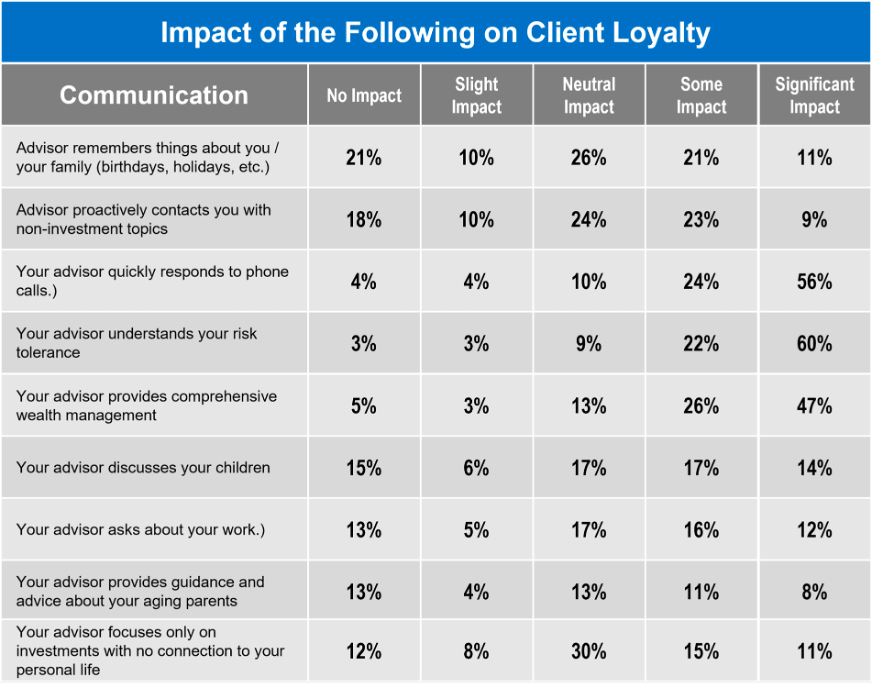

- Michael Kitces on what drives customer loyalty.

Source: The Spectrum Group

- What’s Hot? US ETFs Will Grow to $15 Trillion: JPMorgan's Lake

- Here’s another stat on ETFs that’s very interesting. 4% of ETF AUM is “actively managed” at the end of last year. Flows for actively managed ETFs, however, were 15% of flows in 2022. And, they are now 23% of flows so far this year (at least according to the attached video). With the big mutual fund companies coming into the ETF space, that’s a lot of talent and resources coming into the industry. The huge wave is only getting bigger.

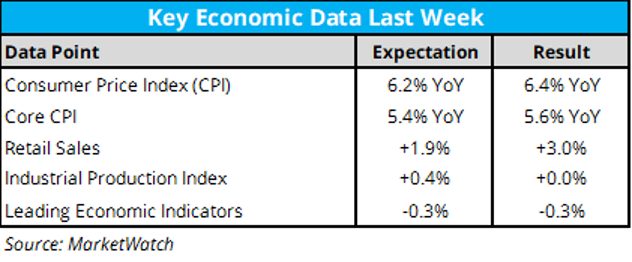

- Economic data last week:

- Last week’s CPI print came as a surprise to the market, rising 0.5% in January and 6.4% year over year (compared to 6.2% expectation). Much of the increase last month came as a result of higher rents, which are a lagging input to the CPI calculation. There is an expectation that these prices will moderate in the context of CPI over the next several months due to generally easing rents at the end of 2022.

- Retail sales came in unexpectedly above expectations. While this reads as a positive indication for the financial health of consumers, the inputs to this increase could be slightly misleading. According to First Trust, January’s retail sales were largely affected by extraneous activity in the auto market, the higher-than-average adjustment to Social Security benefits, and of course, high inflation.

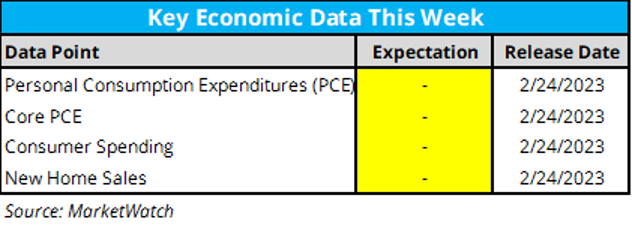

- This week’s economic calendar:

- On Wednesday, we will get the release of the Fed minutes from its last meeting. Last week, St. Louis Fed President James Bullard said he had pushed for a 50 bps rate increase at that meeting. And many now expect one next month.

- Thursday, we get new inflation data with the Personal Consumption Expenditures (PCE).

- Atlanta Fed' GDPNow projection for Q1 GDP jumped from the prior week’s reading to 2.5% from 2.2% on February 15th. The number continues to improve.

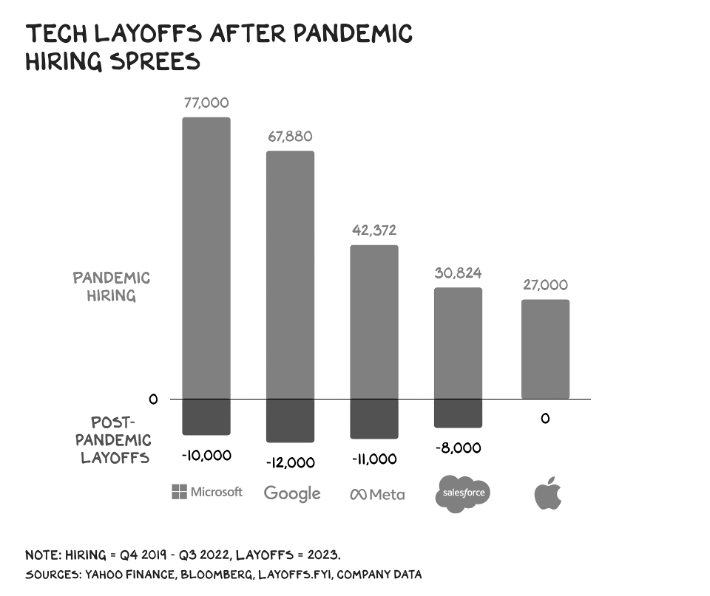

- So much talk and headlines about the layoffs in tech, but how about this following stat I bet you didn’t know? This is from another recent weekly commentary gem by Scott Galloway.

- Speaking of hiring, Fidelity is hiring 4,000 workers.

- An update on earnings from Factset Earnings Insights:

- Earnings Scorecard: For Q4 2022 (with 69% of S&P 500 companies reporting actual results), 69% of S&P 500 companies have reported a positive EPS surprise and 63% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Growth: For Q4 2022, the blended earnings decline for the S&P 500 is -4.9%. If -4.9% is the actual decline for the quarter, it will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%).

- Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager at Brinker Capital

- Cryptocurrency prices jumped last week, despite other risk assets falling. Bitcoin rose 14% to near $25,000, its highest price since last summer. Ethereum also jumped 14% to hover over $1,700. Polygon, Solana, and Polkadot all gained more than 25%. Bitcoin is higher by 50% in 2023.

- Regulatory momentum continued last week, with US senators drafting proof-of-reserves legislation, Canada nearing new crypto exchange rules, and the SEC continuing to be active. The SEC is planning to sue Paxos over unregistered security issuance as well as proposing new crypto custody rules. FTX Japan users can withdraw funds starting today, as the unraveling continues.

- iShares launched the Future Metaverse Tech and Communications ETF (IVRS). The funds' largest holdings are Meta, NVIDIA, and Apple.

- On this week’s Orion's The Weighing Machine podcast we talk to another dear friend, and one who has a record of building some pretty big things. Art Lutschaunig (a Villanova grad), was my boss at Fidelity a few decades ago, and after he established the largest mutual fund wrap product at Fido, he moved on to start, or help start, a bunch of other new products and businesses. I’ve learned a lot from Art over the years, who is still not only professionally active, but is just having fun as a “hippie cowboy” sort of guy.

- Introducing: BeFi20! Developed by Orion Chief Behavioral Officer @danielcrosby, this 20-question assessment gives you better insights into your clients' beliefs, values, & goals about money.

- How about a webinar on OPS’s “Easy Button” MCAM portfolio? Now with three years of track record, the Market Cycle Advised Mandates (MCAM), portfolios are designed to help guide your clients to the right portfolio based on their unique risk tolerance, market participation attitudes, and investment goals. MCAM delivers actively managed, UMA portfolios that align with investor expectations and embody our three-mandate investment process. Hear how you will find allocations that are representative of the models, strategists, and characteristics that are broadly found on the OPS platform in one “easy button” within each portfolio.

- BlackRock/iShares Michael Lane on ChatGPT:

- As the discussions surrounding #ChatGPT and its potential to replace human jobs in various industries continue to swirl, it's natural to wonder if financial #advisors have cause for concern. That's why I loved this article from Samuel Taube, asking ChatGPT questions about personal finance and seeing its answers.

- While AI-powered solutions like ChatGPT may be able to provide information and insights on loads of subjects, including personal finance, relatively accurately, they lack what I see as the biggest part of being a trusted advisor and financial professional: humanity. #AI can't build a relationship with someone, figure out their needs, and manage their finances based on trust, partnership, and compassion, while using the latest and greatest portfolio tools. I’ve also learned over time to not just listen, but to watch. Body language may at some time in the future be “readable” by AI and incorporated, but until then, I know I don’t just listen- I watch how committed someone is to an answer about goals, desires, and needs. Body language is just as important to me, as what someone says. Those are essential pieces of the puzzle to me, and humans are still beating out the chatbots on this one.

- I’ll say this though: As AI continues to evolve and advance, it will be fascinating to see how it impacts the financial services industry. I can't wait to see the ways the world will be different in just a few years. Great story from NerdWallet! http://bit.ly/3KeiQkS

- For more on ChatGPT, visit iShares insights hub: https://bit.ly/3YwAGni

- If you want more on the impact of Artificial Intelligence on the markets, I’ll be interviewing BlackRock’s Jay Jacobs on March’s Orion's Weighing The Risks podcast.

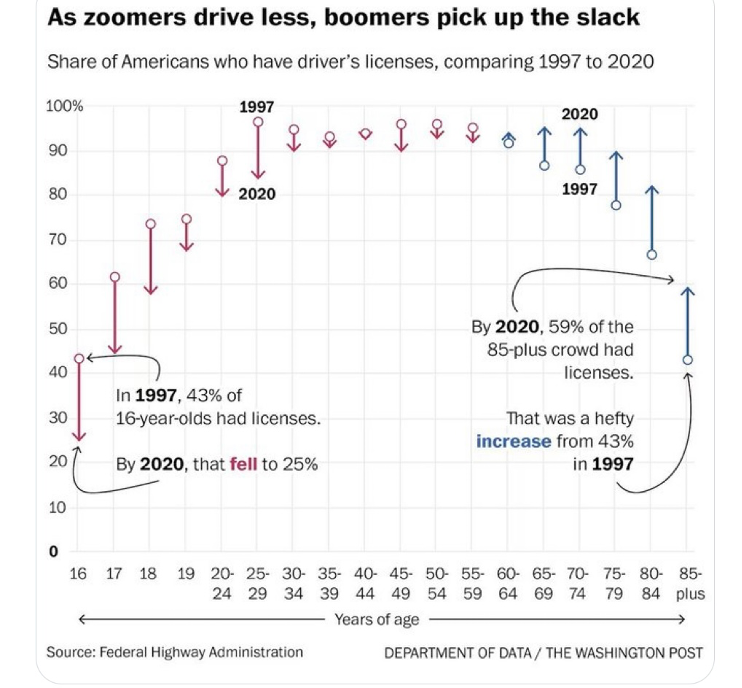

- This isn’t really market related, but I found it fascinating. I bet some of you will too.

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at orionportfoliosolutions.com/blog.

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.

0553-OPS-2/22/2023