The Benefit of Real Asset Investment

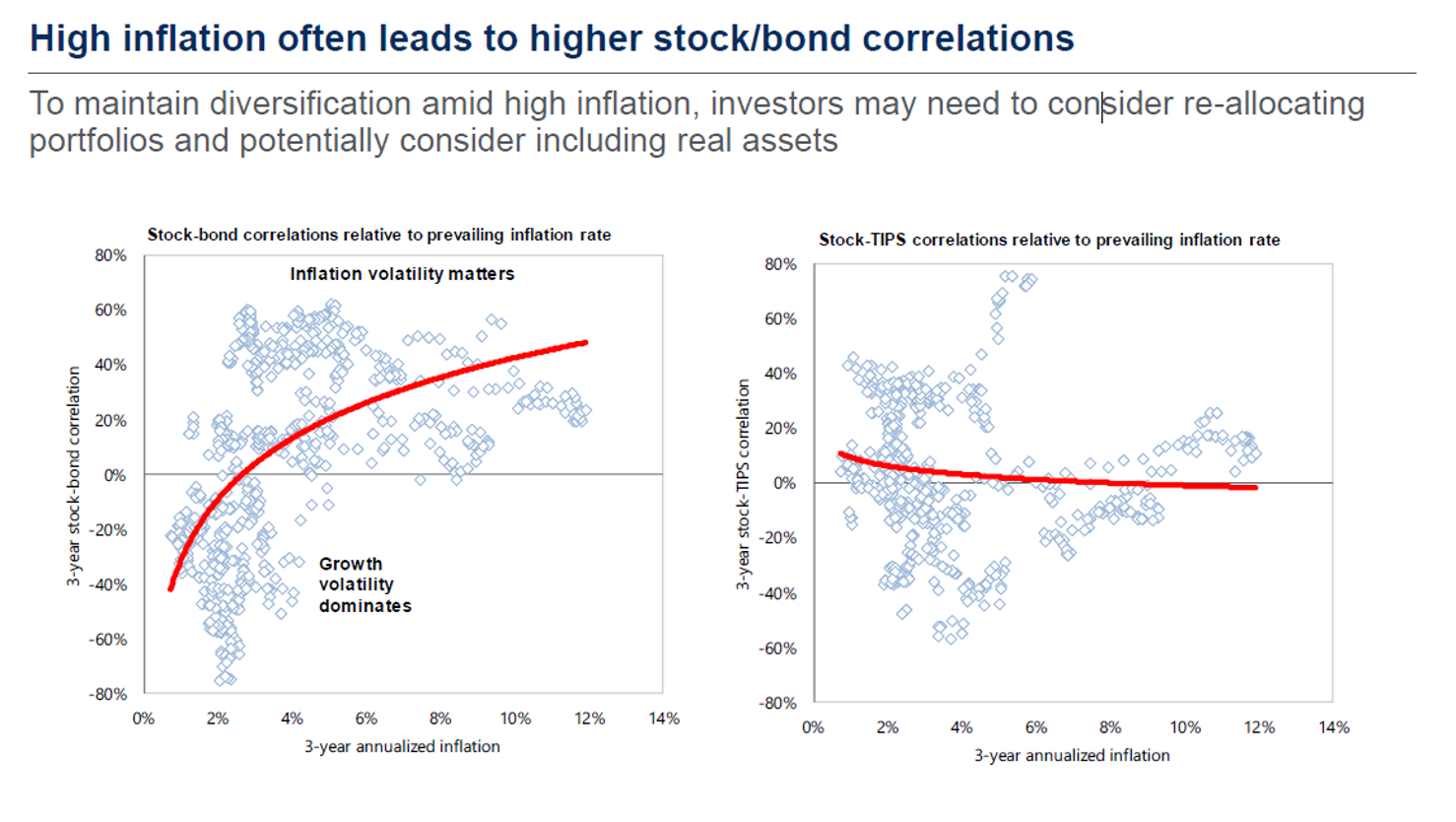

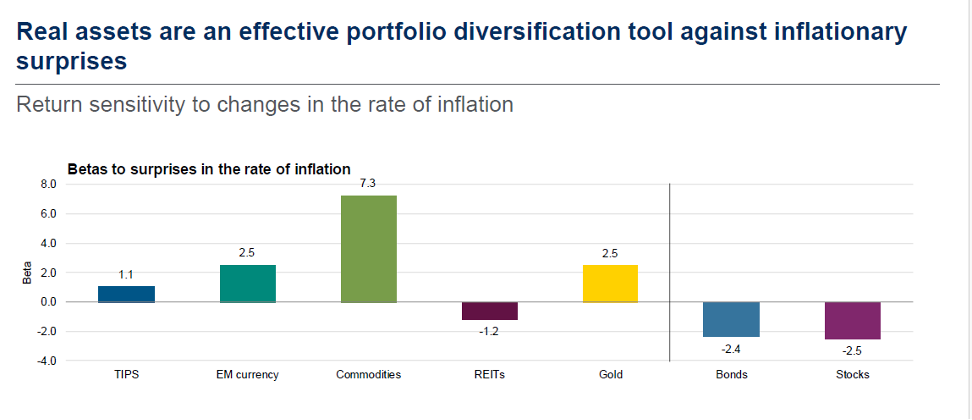

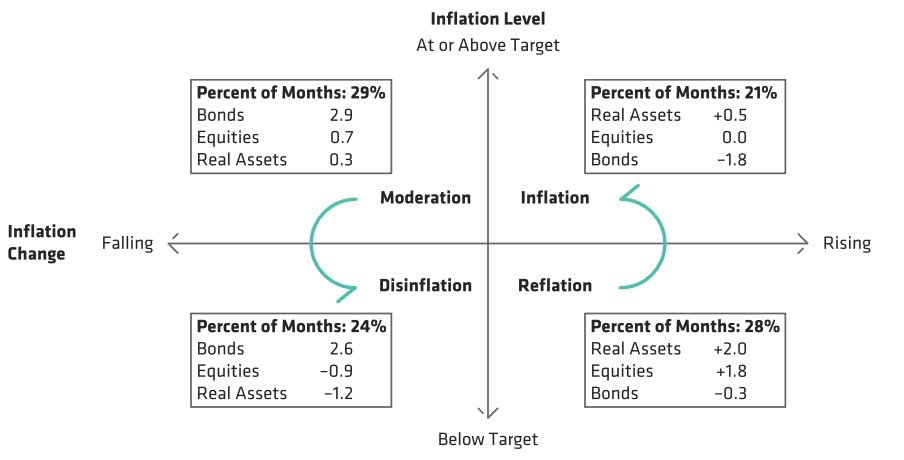

In 2022, investors were faced with an economic event that most had never encountered in their professional careers — the highest annual inflation rate since 1981.1 Rising prices and falling savings rates due to the end of the post-pandemic stimulus period put downward pressure on both equities and bonds as the Fed scrambled to hike rates in response.

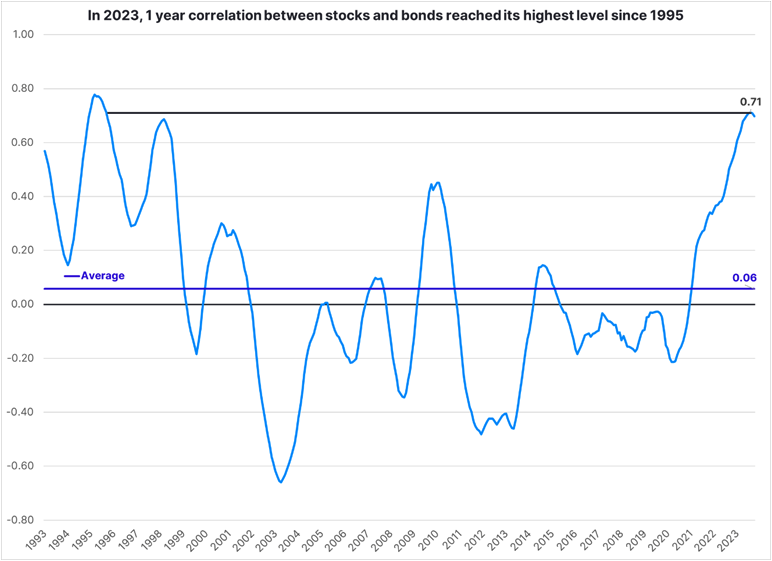

The traditional 60/40 diversified portfolio (60% equities [MSCI ACWI], 40% bonds [Bloomberg US Agg Bond]) lost 16% in 2022 — one of its worst years ever — as the fixed-income sector endured its longest bear market of all time. Investors were reminded that the 60/40 approach may not be as diversified as it appears in certain market conditions. In response, they are increasingly turning to alternative investments to protect their capital during future economic downturns.

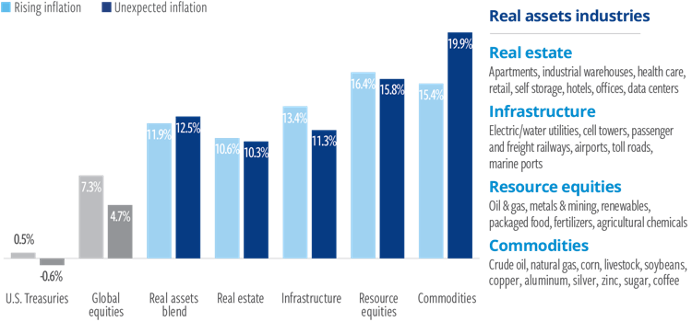

Investing in real assets is a form of alternative investing that provides access to the cash flows generated by some of the most fundamental and essential pieces of the world economy across a wide variety of sectors. Such investments carry an intrinsic value, as they are directly tied to the underlying value of physical assets. Many real assets pay some sort of yield, rewarding real asset investors with consistent income. The more liquidity investors are willing to give up, the larger and more consistent payments they can expect.

Real assets have traditionally been utilized by institutional investors, ultra-high-net-worth investors, and endowments. In fact, Harvard, Stanford, and Yale allocate over 25% of their endowments to real assets.2 These investors have enjoyed the consistent income and inflation-hedging properties that this asset class provides, and the mass affluent investor has many avenues through which to enjoy similar benefits.

What Are Real Assets?

The relevant sectors that we will discuss in the following sections are real estate, commodities, natural resources, and infrastructure. As the mass affluent investor is less likely to be interested in the high upfront costs and low liquidity of private real asset investments, we will be looking at publicly traded, more liquid real asset investment options. To answer the question “What are real assets?” here’s what that looks like for each asset group.

- Real Estate Equities: The most popular option to invest in real estate on a publicly traded level is the real estate investment trust (REIT). A REIT is a company that either finances or owns income-producing real estate. These companies are highly liquid and trade just like a publicly traded stock.

REITs generate revenue by leasing or selling interest-generating mortgages on their properties. They pay almost all their income out in annual dividends, providing a stable income stream for investors.3

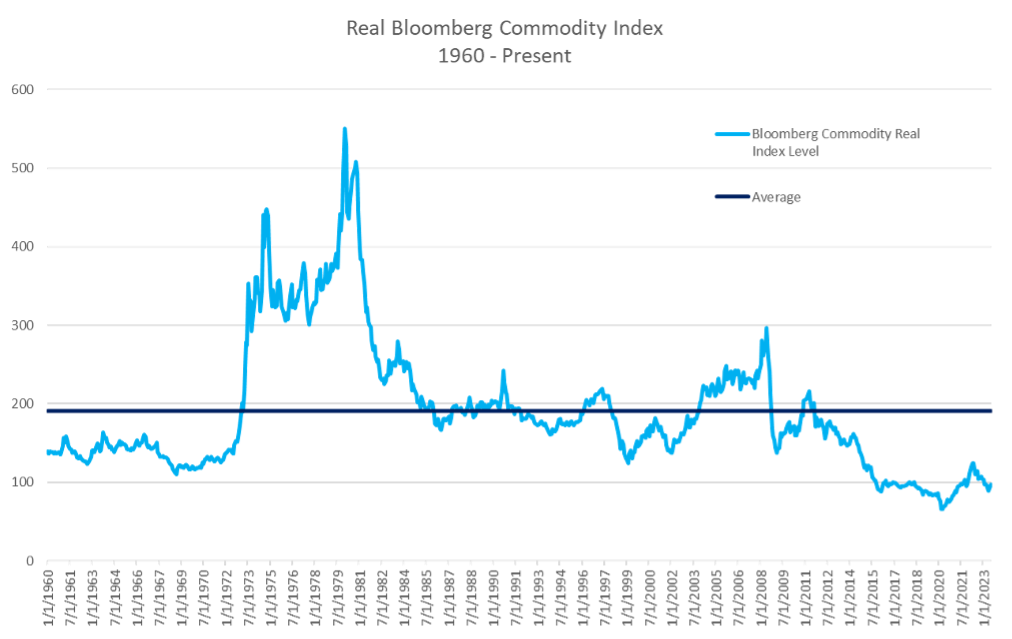

- Commodity Futures: Commodities are the raw materials used in various goods and services. Agriculture, energy, and metal products make up the bulk of the sector. These are perfectly competitive products, meaning one specific product is no different than any other product of the same type. For example, one specific bushel of wheat doesn’t trade for a higher or lower price than any other bushel of wheat.

Investors can allocate to futures contracts or commodity ETFs to gain exposure to the sector, which is well known for its inflation-hedging properties.

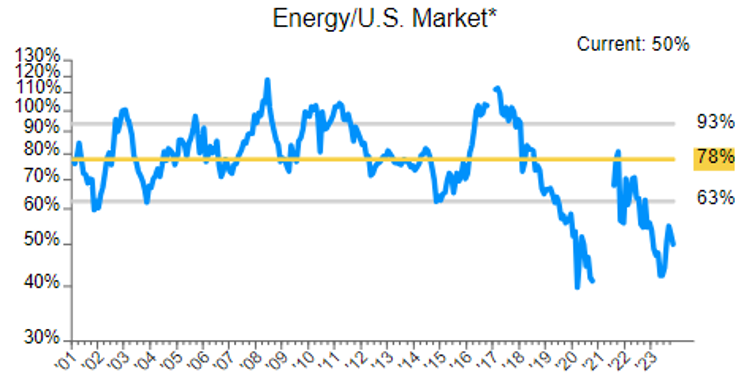

- Natural Resource Equities: Companies that invest in or derive most of their revenue from the production or distribution of natural resources fall into this category.

While some of the products may be the same as those available through commodities contracts, the difference here is the opportunity to invest in a company as opposed to perfectly competitive raw materials. This exposes investors to company-specific equity risk premia and the potential for higher returns through business decision-making.

- Infrastructure Equities: Like natural resource equities, these are companies that invest in or derive most of their income from the manufacturing, generation, or operation of infrastructure. Renewable energy, transportation, communication, and utilities are examples of different sectors within the infrastructure space.

These companies benefit from inelastic demand and stable cash flows due to the high necessity and high durability of their products.

It is important to note that for all these securities, mutual funds and ETFs are available for further diversification within each sector.

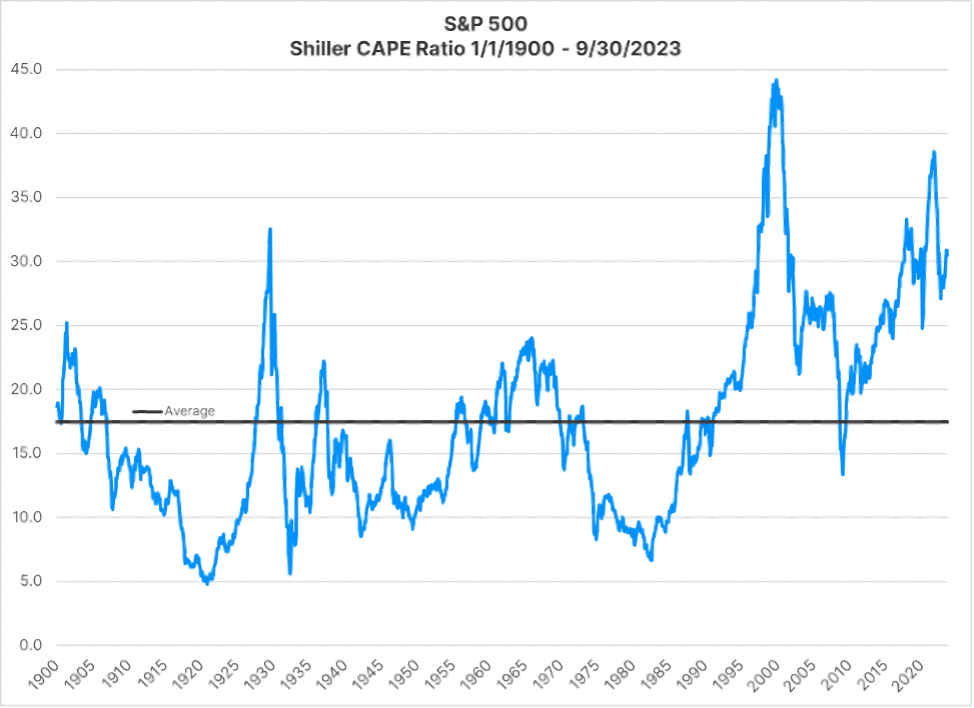

Using both internally conducted and third-party research, we will make the case that current market conditions are calling for alternatives to stocks and bonds. We will then discuss why investing in real assets provide solutions to many of the problems that these conditions cause.

We have identified several trends in financial markets that support our belief that simply investing in a mix of stocks and bonds is neither the most efficient nor the most effective way to diversify portfolios. We will first discuss each condition and then why we believe an allocation to real assets can help protect portfolios from the risks resulting from each trend.