Related Content

¹Source: Personal Benchmark: Integrating Behavioral Finance and Investment Management, Charles Widger and Dr. Daniel Crosby, 2014.

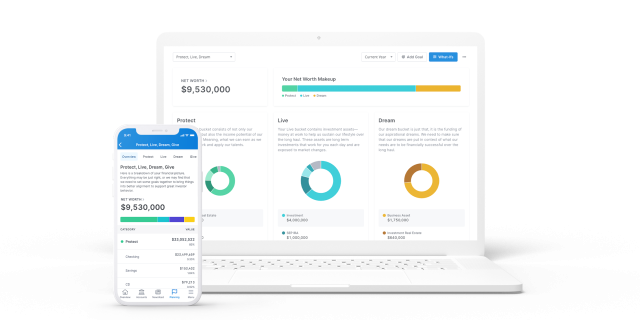

Protect, Live, Dream

The BeFi tool that empowers clients to focus on their motivations, not their neighbors.

Why Goal-Based Investing?

Manage behavior — not just money — with Orion’s proprietary Protect, Live, Dream framework, which lets you bucket your client’s investments into distinct areas, enabling you to work toward their unique goals, not arbitrary benchmarks.

Developed by Chief Behavioral Officer Dr. Daniel Crosby, this innovative BeFi tool will help you keep investors’ eyes on individual aims, not market fluctuations, reduce panic selling, and create more informed financial plans that spark deeper client conversations and drive better financial outcomes

75%

50%

Create Customizable Buckets for Clients

Because not all goals are created equal.

Protect

This bucket consists not only of “safe” assets but also the income potential of human capital.

Live

This bucket contains those investment assets that work to sustain a client’s lifestyle over the long haul.

Dream

This bucket funds aspirations, or the things a client hopes to do but that are not immediate needs.

Or Personalize

Want to build custom buckets? Go beyond the standard framework and build up to four personalized buckets, tailored to your clients' goals.

How It Works

Step 1

Start with your clients' 3D Risk Profile to determine their risk comfort level by evaluating their life and finances from multiple dimensions.

Step 2

Next, go through the personalized planning workflow in Orion Planning that works to bucket your client’s investment strategy into the Protect, Live and Dream buckets.

Step 3

Finally, provide clients with a financial plan catered to their unique goals that’s designed to keep them on track in all market environment.

See Behaviors, Strengthen Outcomes

Investing isn’t logical. Orion’s Protect, Live, Dream framework taps into human psychological tendencies to help advisors guide clients toward behaviors that align with their unique short- and long-term goals.

Instead of being influenced by the market or the Joneses, investors stay focused on their objectives and remain calm in times of volatility.

The Future of Finance is Behavioral

Unite financial know-how and psychological principles to support clients.

BeFi20

Introduce investors to their money persona and use those insights to launch deeper conversations.

3D Risk Profile

Understand your client’s risk tolerance on three dimensions so you can create more personalized recommendations.

Advisor Academy

Grow your business and earn CE credit with our practice management courses.

Ready to Implement a Goal-Based

Investing Strategy?

Let’s connect to explore how a goals-based investing solution can help enhance your client’s financial future.

Related Content

¹Source: Personal Benchmark: Integrating Behavioral Finance and Investment Management, Charles Widger and Dr. Daniel Crosby, 2014.