The Weighing Machine – A Year in Review · Stay Diversified – Bond Outlook Improves · Always Be

Portfolio Advice, Talking Points, and Useful Resources

- A Year in Review: In 2024, the weekly Weighing Machine podcast delivered engaging conversations with industry leaders, innovative thinkers, and investment experts, offering diverse perspectives on market trends, portfolio strategies, and the evolving financial landscape. We list a few highlights.

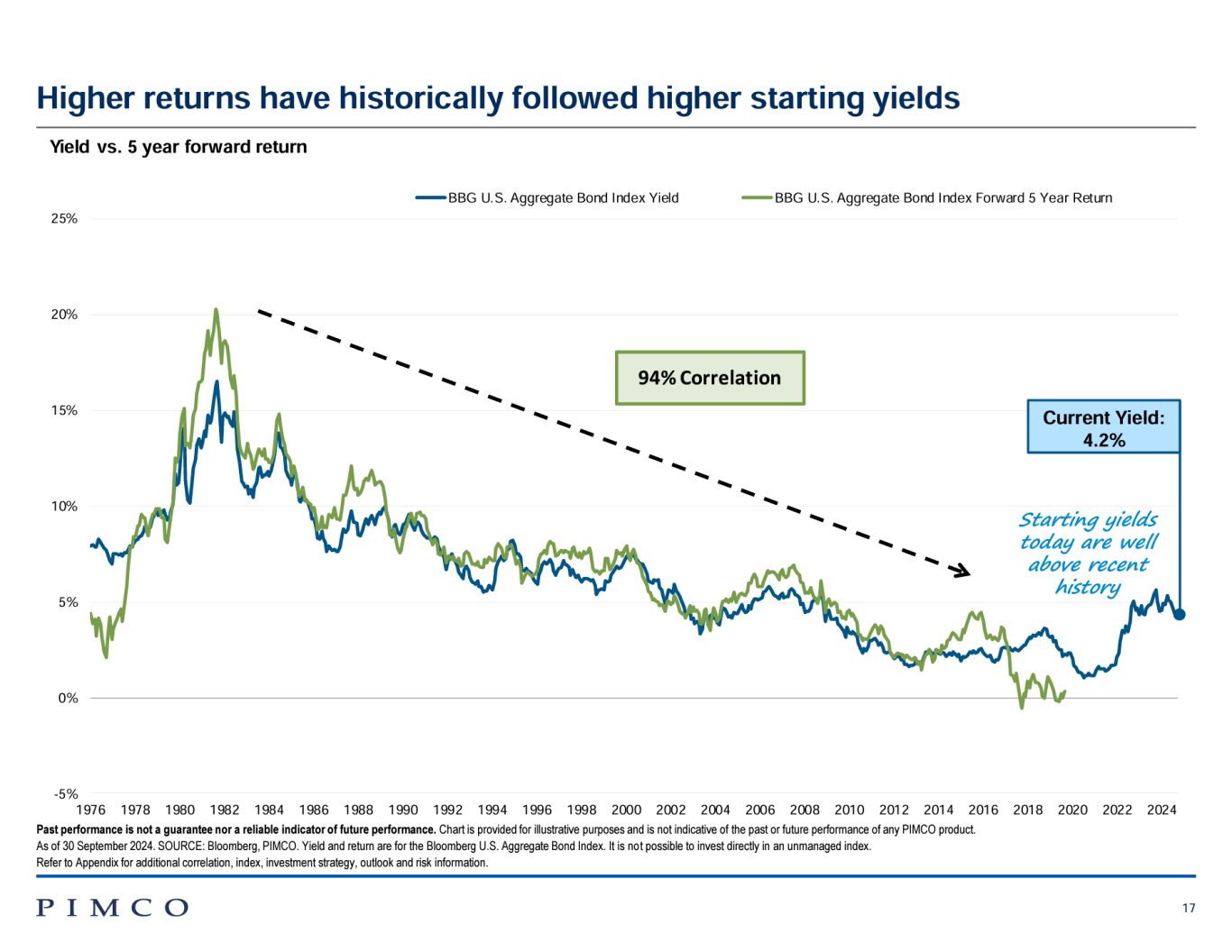

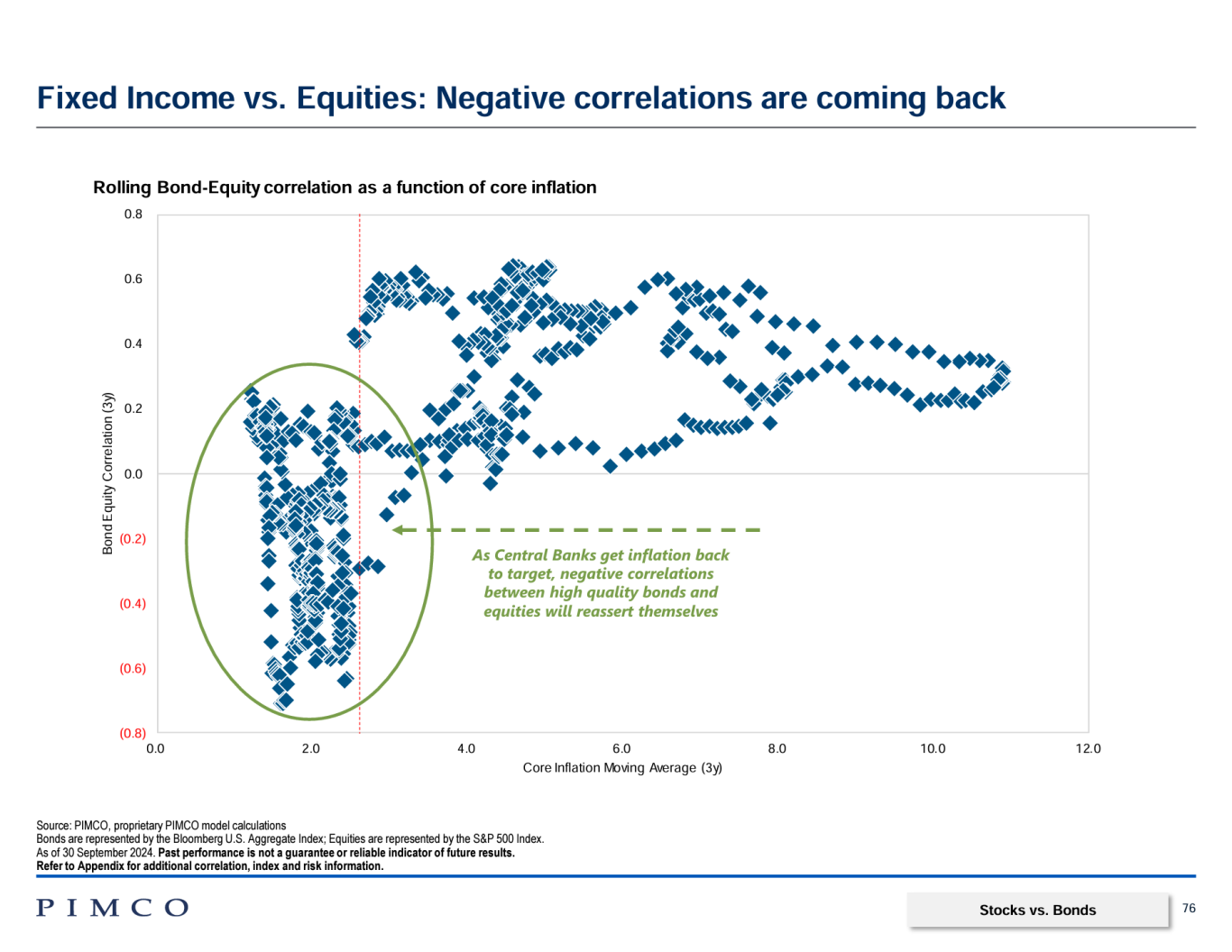

- Bond Outlook Improves: Following another challenging year for fixed income, the bond outlook appears more promising with higher starting yields and inflation retreating from its peak.

- The Power of Gratitude, Humility, and Strength: Embracing gratitude, humility, and strength can empower long-term investors to navigate challenges and achieve lasting success.

Happy New Year!

As we enter a new year, it is a good time to reflect on the current market environment. Despite the challenges we have faced this year, from stubborn inflationary pressures to geopolitical uncertainties, there are reasons to feel cautiously optimistic about what lies ahead.

While market volatility can sometimes test investor patience, it is important to remember that periods of stress and volatility are part of the investment journey. As investment manager Phillip Toews has said: “There is no ‘likelihood’ of down markets or recessions — there is a certainty.” Historically, staying disciplined and focusing on long-term goals has been a winning strategy.

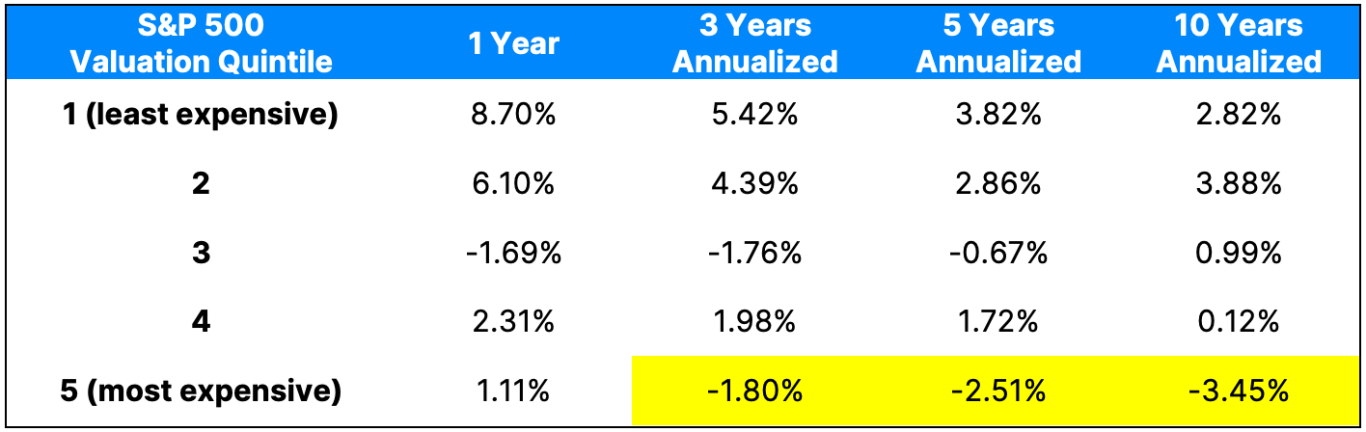

Uncertainty is a constant, which is why diversification is crucial to building a resilient portfolio that investors can stick with through different economic regimes and emotional narratives in the financial press. However, diversification is not just about spreading investments across asset classes. It is about thoughtfully balancing risk and reward.

Currently, one area we are closely monitoring is fixed income. With higher yields available, bonds have become more attractive, offering both income and a hedge against equity market volatility. In this month’s report, research investment analyst Nolan Mauk provides a compelling argument to maintain fixed-income exposure, despite its overall performance in recent years.

Ultimately, we believe that staying invested, diversified, and disciplined is the key for investors to navigate market and economic uncertainty with confidence and stay on course toward their financial goals.

The Weighing Machine Podcast: Top Highlights from the Past Year

By Rusty Vanneman, CFA, CMT, BFA, Chief Investment Strategist

We just wrapped up our seventh full year of Orion's The Weighing Machine weekly podcasts, and it was another fantastic year! We launched the podcast with the goal of helping financial advisors and investors achieve their long-term financial goals.

The title of the show — The Weighing Machine — was inspired by the classic investing saying often attributed to Benjamin Graham (or Warren Buffett): “The stock market is a voting machine in the short term and a weighing machine over the long run.” In other words, while emotions and expectations drive short-term market movements, fundamentals and valuations determine long-term returns.

Our mission at The Weighing Machine is to provide financial advisors and investors with thoughtful, actionable insights that foster confidence in understanding and navigating the wealth management landscape. The value proposition lies in delivering engaging conversations with industry leaders, innovative thinkers, and investment experts. We aim to offer diverse perspectives on market trends, portfolio strategies, and the evolving financial landscape with the goal of inspiring better financial outcomes and strengthening professional relationships.

On our first podcast of 2025, my co-host, Robyn Murray, and I reflect on some of our favorite highlights from the past year. We also turned The Weighing Machine’s signature closing questions on ourselves! It wasn’t easy to narrow down our top three moments, given the incredible guests and topics we covered, but here are the three I picked.

Cliff Asness of AQR – Balancing Risks and Rewards for a Quantitative Approach

"Diversification always works. It just works for different people at different times." – Cliff Asness

Cliff Asness is a living legend in the industry. He is not only a well-known and successful money manager, but he is also a thought leader and an award-winning researcher. He is the founder, managing principal, and chief investment officer at AQR Capital Management. Throughout his career, he has received multiple awards, including five Bernstein Fabozzi/Jacobs Levy Awards from The Journal of Portfolio Management in 2002, 2004, 2005, 2014, and 2015. The Financial Analysts Journal has honored him with the Graham and Dodd Award for the year's best paper twice, as well as a Graham and Dodd Excellence Award, the award for the best perspectives piece, and the Graham and Dodd Readers’ Choice Award.

In this episode, Robyn and I had the honor of talking to Cliff for nearly two hours (more than twice as long as the average Weighing Machine podcast), but it did not feel like it was long enough. I described the experience as watching your favorite jam band for a three-hour show. Cliff is eminently quotable. The podcast was titled “Balancing Risks and Rewards for a Quantitative Approach," but it covered a lot of ground for investors. Some highlights included:

- Behavioral Finance: Cliff emphasized the role of behavioral finance in overcoming psychological biases. He also stressed that educating clients about these biases can help them make more informed investment decisions.

- Quantitative Investing Evolution: Reflecting on the past decade, Cliff noted significant changes in quantitative investing, highlighting the importance of adapting to market changes and client needs.

- Value Investing: Cliff shared his thoughts on the long-term prospects of value investing (he is optimistic) and about the factors influencing value investing's performance and its relevance in current markets.

Jerry Parker of Chesapeake Capital – The Most Successful Turtle Trader: Lessons From a Career of Systematic Investing

(On trend following and discipline): "I think if you are willing to submit yourself to rules and not be upset or jealous when people are doing better, seemingly, by not using rules ... I think over time this type of strategy will work out, and win out, eventually, but not on a day-to-day basis." – Jerry Parker

Jerry Parker, CEO of Chesapeake Capital, is the chair and chief executive officer of Chesapeake and Chesapeake Holding Company. Jerry started his trading career in 1983 for the also-legendary Richard Dennis in his “Turtle” training program. As a portfolio manager, Jerry has overseen Chesapeake’s operations and its trading since its inception in February 1988. Key highlights of the episode included:

- Discipline: Jerry emphasized the importance of a rules-based, systematic approach to investing, which promotes discipline and consistency. He noted that adhering to established rules can provide confidence, as these strategies have demonstrated success in the past.

- Selecting Investment Managers: Prioritize those with a clear, disciplined approach to trend following and a record of success in systematic investing.

- Client Education: Jerry acknowledged the challenges investors face in sticking with systematic strategies, especially during periods of underperformance. He suggested that educating clients about the long-term benefits of such approaches can help in maintaining discipline.

Alex Fink – Leadership Advice from a U.S. Army General

(On cultivating organizational culture): "You can’t just say, 'hey ... this is our culture, this is what we are going to be about' [and] put it on a bunch of cards and pass them out and think it’s just going to last. It’s something that has to be constantly nurtured and reinforced ... with examples.” – Alex Fink

Alex Fink is a recently retired U.S. Army Major General and former chief marketing officer for the U.S. Army. General Fink is credited with reinventing the classic “Be All You Can Be” campaign. He served for more than 33 years in a variety of domestic and overseas operational and strategic leadership positions. He also serves on USO’s Midwest Region Advisory Board and as an executive board member for the Boy Scouts of America’s Pathway to Adventure Council.

In this episode, General Fink shared valuable insights on leadership, team building, and innovation. The following highlights include what I thought were useful action items for financial advisors and all leaders:

- Develop a Consistent Leadership Approach: Establish a personal leadership style that sets clear standards and expectations, promoting trust and enabling team members to make informed decisions independently.

- Cultivate and Maintain Organizational Culture: Actively nurture your organization's culture by embodying and reinforcing its values, ensuring that team members understand and align with the collective mission.

- Encourage Innovation: Create a supportive environment that encourages team members to propose new ideas and approaches, fostering a culture of continuous improvement and adaptability.

It was a fantastic year for The Weighing Machine, and we have an exciting lineup of guests scheduled for 2025. We would love to hear your thoughts on any episodes and welcome your suggestions for future guests. If you enjoy the podcast, don’t forget to subscribe!